Livestock Risk Protection

Published

12/1/2023

Have you looked at the improved Livestock Risk Protection (LRP) policy lately? Farm Bureau policy supports the development and maintenance of “adequate risk management tools for livestock producers1, and judging by the numbers of animals insured withLRP, from its inception in 2003 through 2020, the LRP policy was arguably less than adequate. However, with the passing of the Bipartisan Budget Act of 2018, several improvements were made. While it takes time to go from law to regulation, coupled with a COVID-19-slowed rollout, the number of livestock has increased exponentially over the last couple of years.

LRP offers protection against price declines by indemnifying producers if prices drop below a predetermined level. It is available for feeder cattle, fed cattle and swine. It doesn’t protect against poor gains, poor quality or death loss. Premium rates, coverage levels and actual ending values are available online here, or from your local Farm Bureau Financial Services agent.

Two changes in particular have helped. First, the number of animals that can be insured was increased. For fed and feeder cattle, the annual limit went from 2,000 head to 25,000 head, and for swine it increased from 32,000 to 750,000 head.

Second, and most impactful change, was the increase in the level of federal cost-share. When first released, the cost-share was 13 percent, leaving farmers and ranchers on the hook for the remaining 87 percent of the premium. Far less than the average federal cost-share of 62 percent available for crop insurance. Today, depending on the coverage level, the federal cost-share will range from 35 up to 55 percent.

For the rest of this article, I’m going to focus on feeder cattle, but many of the terms and explanations also apply to fed cattle and swine. For more detailed information and to run some quotes, contact your local agent.

Step One. Complete a one-time application with your agent, preferably before you’re ready to examine and purchase a Specific Coverage Endorsement (SCE), which is the policy specific to the animals you wish to insure.

Specific Coverage Endorsements

- Are offered over 10 time periods, ranging from 13 to 52 weeks in length. Note: Some SCEs may not be available on any given day if price or rating information is insufficient.

- The policy is settled on the SCEs “End Date,” corresponding to the end of the period selected. Note: Cattle must still be owned within 60 days of the End Date, but can also be retained past the End Date.

- Coverage Prices range from 70 to 100 percent of the “expected” ending value of the CME Feeder Cattle Index™2.

- For beef breeds, you must specify between steers and heifers, in addition to a “weight.” Weight 1 are calves under 600 lbs., Weight 2 is 600-1,000 lbs.

- Other types of feeders that can be insured include predominantly dairy and predominately brahman, utilizing the same weight categories as above, or you can also select and insure unborn livestock (beef steers & heifers, brahman, or dairy).

- The maximum number of head per SCE is 12,000; max per year is 25,000 head.

To demonstrate, let’s look at a simple feeder cattle example. It’s Nov. 21, 2023 and I’ve recently weaned 100, 450-lb. steers. My plan is to retain ownership over the winter, aiming for 2.25 lb. average daily gain, and a target sale date around the last half of February with the calves weighing 675 lbs., or 6.75 hundred weight (cwt.).

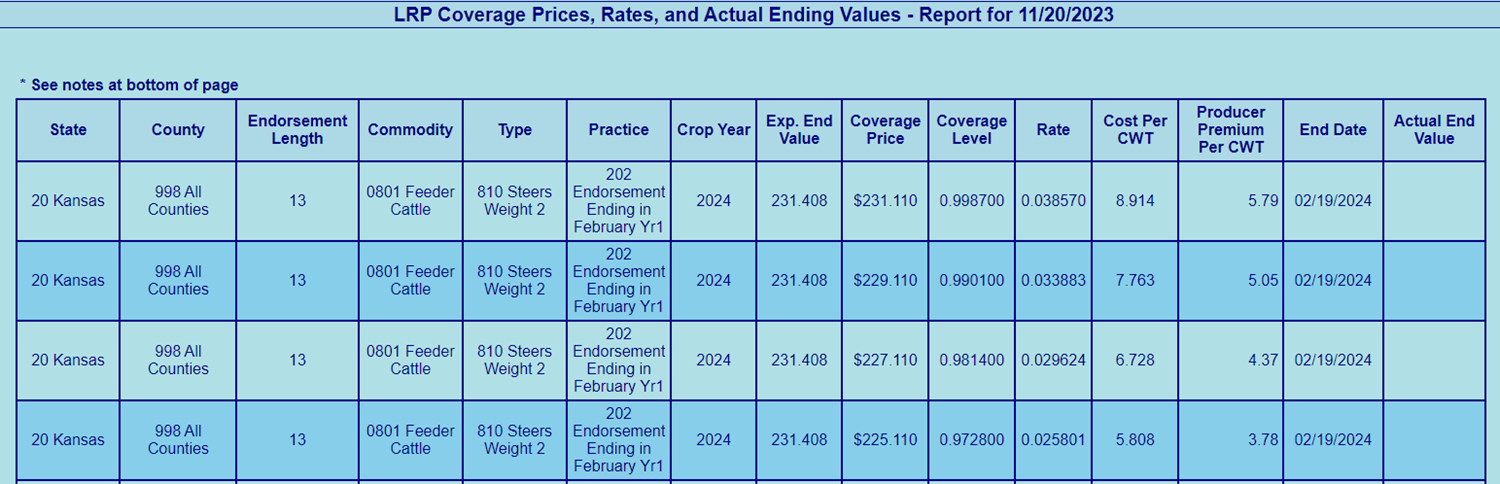

Table 1. An LRP Feeder Cattle Report for November 20, 2023 (partial screen shot)

Screen shot shows the top four rows (13 week time period), after selecting: Feeder Cattle, Kansas, Weight 2 (600-1,000 lbs.) https://www.rma.usda.gov/en/Information-Tools/Livestock-Reports

Key columns to focus on include:

- End Date, the last day of the specified time period and the date in which the SCE will be settled. In this 13 week example, it is falling on Feb. 19, 2024.

- Exp. End Value, which is the expected CME Feeder Index value on the End Date. On Nov. 20, 2023 this value was $231.408/cwt.

- Coverage Price, which is your price guarantee! Calculated as the Expected End Value multiplied by the Coverage Level. For the first row this is $231.11 ($231.408 x 0.9987).

- Cost Per CWT, the total premium cost per hundred weight.

- Producer Premium Per CWT, the farmer/rancher share of the premium ($8.914 x 0.65), implying a 35 percent federal cost-share. For the first row, this is $5.793 per cwt.

Producers can estimate what the minimum net calf price would be after selling at your local salebarn, given the specific SCE purchased by adjusting the coverage price by your expected feeder calf basis4 and the LRP premium.

$231.11 | LRP Coverage Price | |

| plus | $20.00 | Expected Basis at time of sale (Feb. 19, 2024) |

| minus | $5.79 | LRP Premium |

| equals | $245.32 | Expected Minimum Net Selling Price (EMNSP) |

The EMNSP represents the minimum price you’ll receive because if feeder cattle prices fall, you will receive an indemnity, bringing your net price back up to that level. For example, assuming that our basis estimate is correct, and that historical feeder calf market relationships between futures, my local auction and the CME Feeder Index hold, if we suffer a $30 per cwt. decline in prices, March feeder cattle futures would be $202.30 (down from $232.30 in November), and my local cash price would be $222.30 ($202.30 + $20.00). Because the CME Feeder Index is “settled” with futures, it would also be $202.30, providing a $28.81 per cwt. indemnity ($231.11 coverage price less the $202.30 CME Feeder Cattle Index).

Here's the math.

| $222.30 | per cwt. price received at the local auction, February of 2024 | |

| plus | $28.81 | per cwt. indemnity |

| minus | $5.79 | LRP Premium |

| equals | $245.32 | Net Selling Price to the farmer/rancher |

If prices rise $30 per cwt., producers can take part in the increase, less their premium, netting out a price greater than the EMNSP.

| $282.30 | Local Auction ($262.30 futures + $20.00 basis, February 2024) | |

| plus | $0.00 | per cwt. indemnity ($262.30 CME Index > $231.11 coverage price) |

| minus | $5.79 | LRP Premium |

| equals | $276.51 | Net Selling Price to the farmer/rancher |

Clearly, the increased federal cost share has made LRP more competitive as a tool for protecting the price of livestock and should be a product farmers and ranchers consider along with other tools such as futures or options. Especially for smaller producers, who may not fully utilize the 50,000 pounds represented in a futures or options contract.

A Few Points Regarding LRP as a Marketing Tool

- LRP is less flexible, only settling on the End Date specified in the SCE purchased. Alternatives such as CME futures and options can be bought or sold anytime, allowing producers to take advantage of a rapid run up in prices before prices might retrace lower.

- LRP can better match the pounds of actual sales than futures or options can, which are traded in 50,000 pound contracts, potentially making the user over or underhedged.

A Few Notes on Unborn Steers and Heifers

- This policy was designed to cover bulls and heifers unborn on the date you purchase the policy, using a target weight less than 600 pounds.

- Covering both bulls and heifers simplifies things as it allows you to cover ALL of your calf crop with one SCE as opposed to needing one SCE for bulls (steers) and a second for your heifers.

- It only protects against price declines (not death loss).

- Must verify that you have enough cows to produce the number of calves insured.

- The Specific Coverage Endorsement time period (End Date), should at a minimum coincide with the end of your calving season, but by buying a longer time period (i.e. 43, 47 or 52 weeks) can also be used to protect prices up to and through weaning. For example, in early December 2023, SCEs with End Dates of Sept. 30 and Oct. 28, 2024, were available.