2024 Prospective Planting and Grain Stocks Reports

Published

4/5/2024

You’ve seen the headlines, “U.S. farmers expect to plant less corn and more soybean acres.” Initially, corn prices reacted positively with December CME Group futures up 15 cents the day of the report. Since then, however, prices for all three major crops (corn, wheat and soybeans) have crept back to near pre-report levels. On March 28, we got the double dose of the March Prospective Plantings and Grain Stocks reports, and while the overall acreage data was positive to prices, the stocks data was more negative.

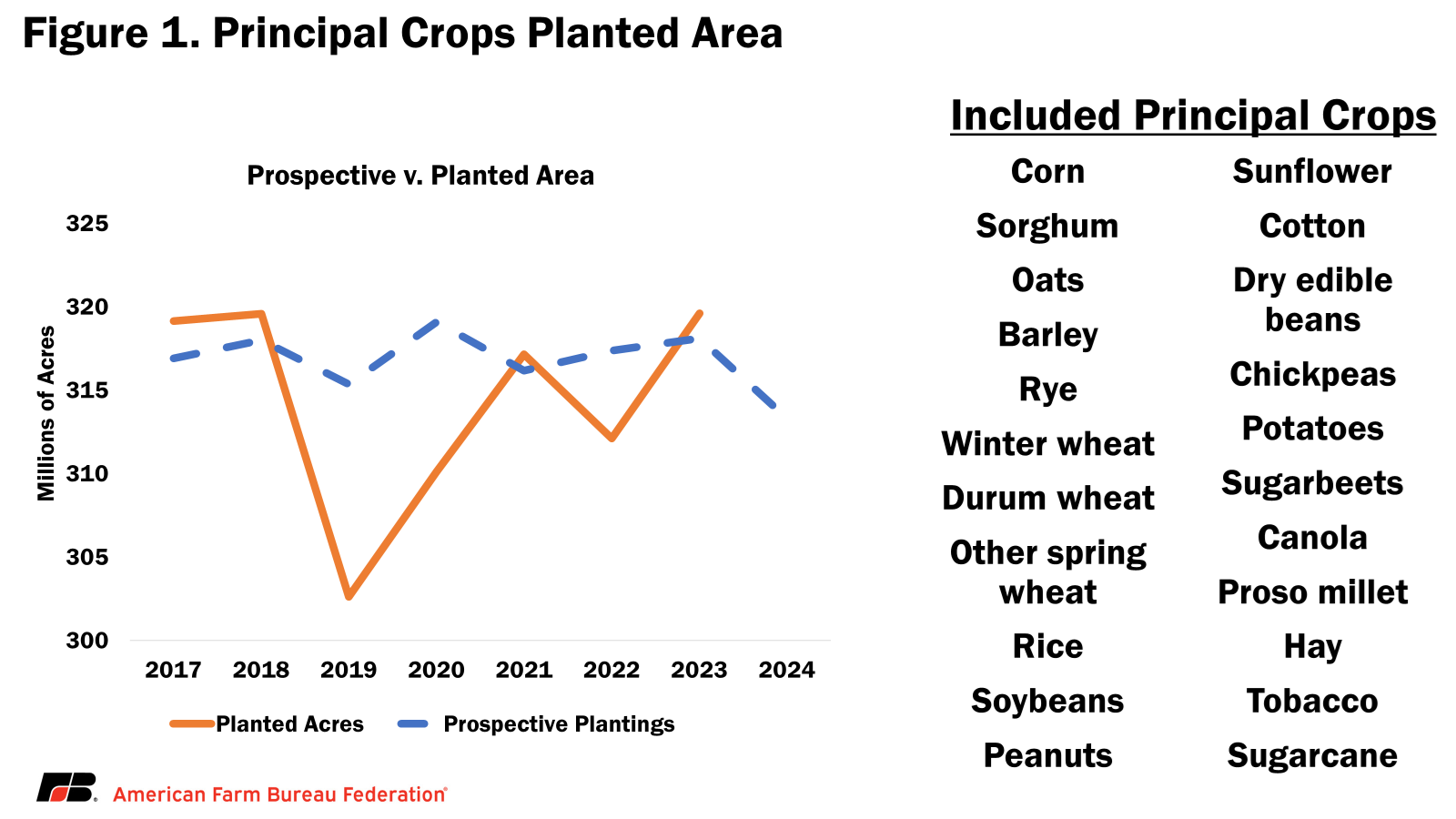

American Farm Bureau Federation (AFBF) Economist, Betty Resnick does a great job of recapping the data here. Something she highlights is, “USDA surprised analysts and farmers alike by estimating total acres of principal crops at 313.3 million acres, down 6.3 million acres (2 percent) from 2023 planted acres. The 2 percent drop in prospective planting crop acres is the largest to date in the eight years since the metric was introduced in 2017.” She also noted, “Kansas and Texas lost the most acres, losing 1.3 and 1.2 million acres representing 5 percent of each states’ principal crop planted acres, respectively.”

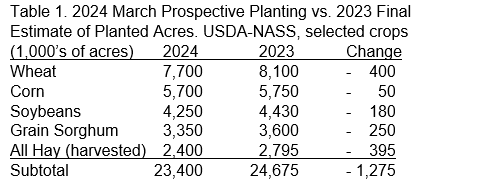

Here’s a closer look at a few of the estimated acreage changes for Kansas from the March Prospective Plantings report, noting that the 22 principal crops were estimated at 23.756 million acres, down 1.268 million from 2023.

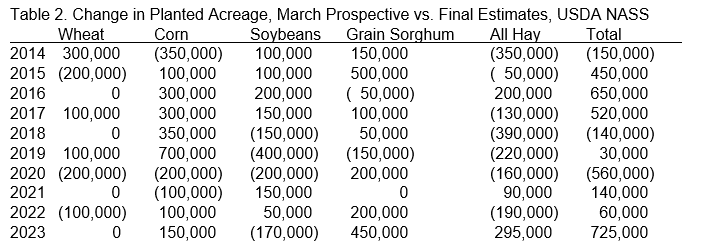

The entire reduction in Kansas acreage is reflected in the five crops listed above, and while historically, actual Kansas crop acreage planted increases over the initial March survey, for example, over the last 10 years, the average change in acreage in these five crops, from March to final, has been a relatively small increase of 172,500 acres, individual years have experienced significant acreage shifts. In fact, five of the last 10 years have experienced an acreage change from March to final estimate of 450,000 acres or more, with 2023’s increase of 725,000, being the largest.

In summary, principal crop acres planted in Kansas this year are estimated to be 1.268 million fewer than in 2023, and while acreage will very likely be less, many other factors can and will impact how many acres ultimately get planted. Weather, input costs and commodity prices being three important ones.

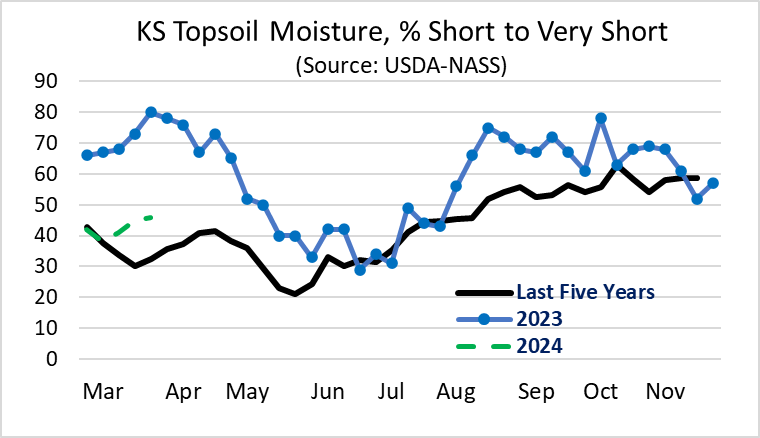

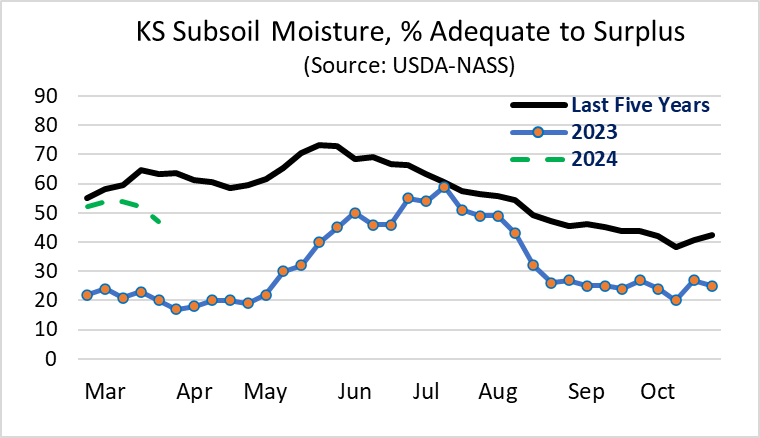

Weather: Both topsoil and subsoil moisture levels are better than a year ago (but worse than the five-year average), and the shorter run, April-June forecast suggests good conditions during planting, with warmer temperatures and above average precipitation forecast, which could encourage greater plantings. But the July-September forecast turns hotter yet, and drier.

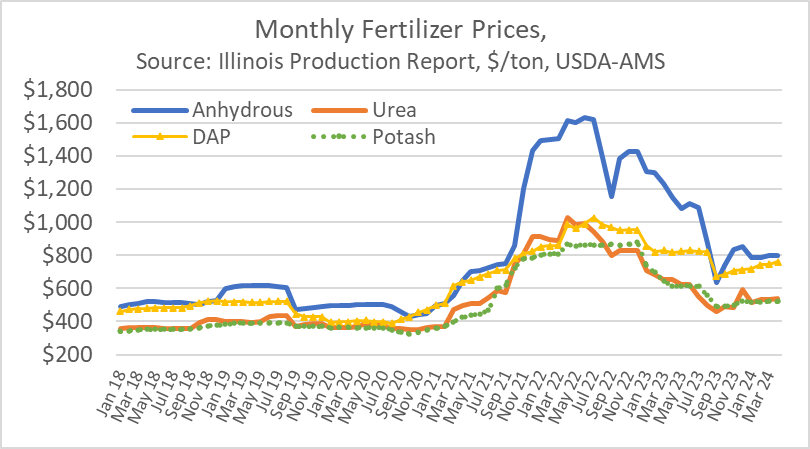

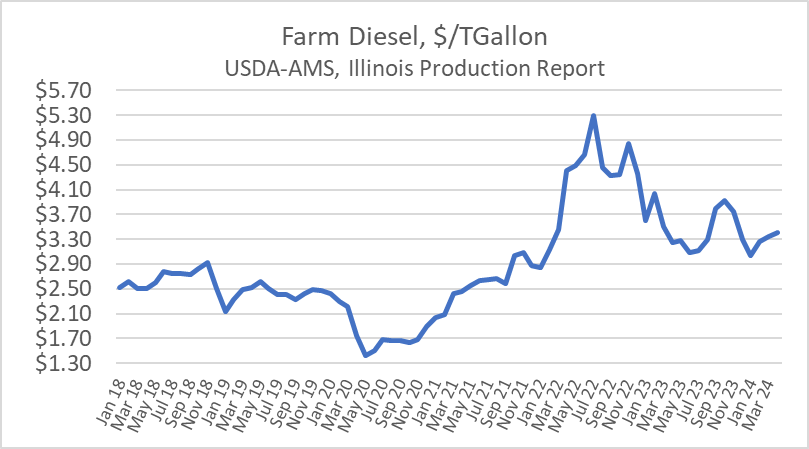

Input Costs: While it will be a long time coming before we get back to negligible levels of inflation; as shown in the charts below, fertilizer prices are well below levels a year ago while diesel prices are up 16 cents per gallon from last April.

(Prices as of the first of the month through April of 2024, USDA-AMS, Illinois Production Cost Report)

Commodity Prices: New crop prices are well below levels a year ago so farmers will need to carefully assess their costs and profit potential. A great place to start may be with KSU’s 2024 Crop Budgets.

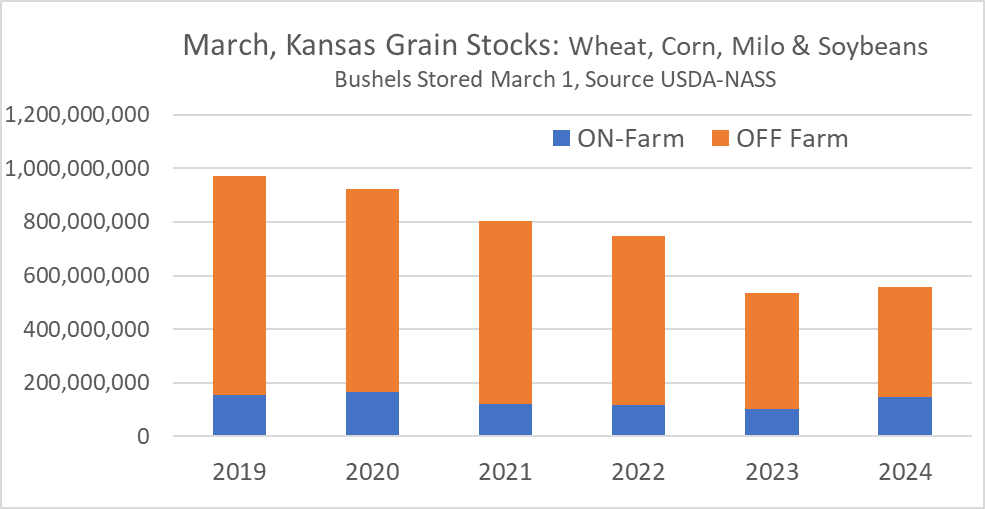

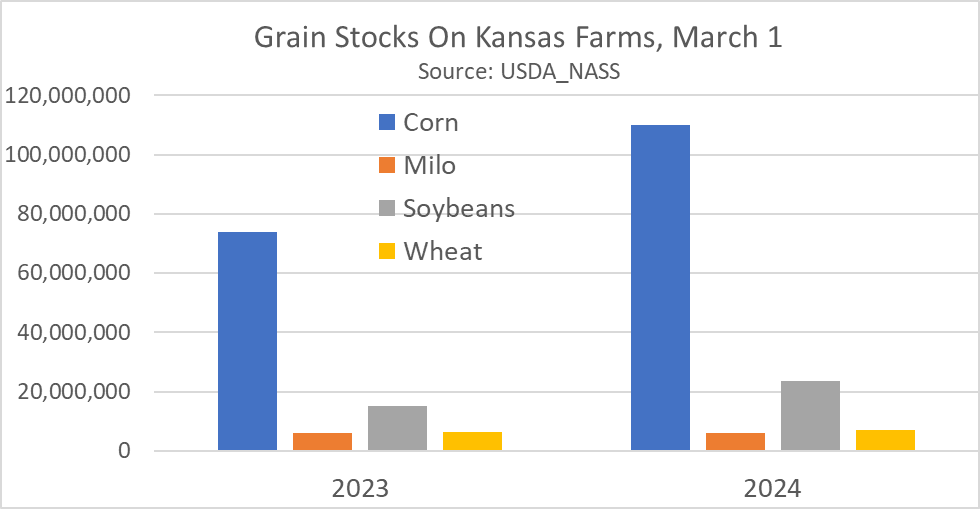

The other significant report was the March Grain Stocks report, overall, stocks in all positions in the U.S. were largely up. Corn stocks, up 13 percent from March 2023 (KS +14 percent), soybean stocks up 9 percent (KS +0.4 percent), all wheat stocks up 16 percent (KS –3 percent). The exception nationally was grain sorghum stored in all positions, which was down 3 percent from a year ago (KS –6 percent).

In Kansas, combined stocks of wheat, corn, grain sorghum and soybeans stored on farms, at 146.4 million bushels was up 44 percent from 2023. Corn, at 110 million bushels, is by far and away the main commodity stored on Kansas farms, making up 75 percent of all grain/oilseeds stored. Combined stocks OFF farm in Kansas, at 410.7 million bushels was down 5 percent from a year ago.

On March 28, USDA provided a lot of data based on surveys of farmers and others, and if you were one of the 3,702 Kansas farmers surveyed, thank you for taking the time to provide this information. Market prices will fluctuate based on traders’ interpretations of available information. And while farmer planting intentions will change, and grain will be sold, fed, processed and exported, at least for now, market prices are fluctuating based on data from this unbiased, USDA survey of Kansas farmers, as opposed to the biased views of other market participants.