Inside the Markets with Mark Nelson: Pricing in a Downtrending Corn Market

Published

7/10/2025

Overall, conditions and yield prospects remain good for Kansas fall crops this year. In fact, according to the National Agricultural Statistics Service, over July 4, the percent of Kansas corn rating good-to-excellent was 72 percent, the highest it’s been, at that time, in the last 15 years. The nations corn crop too, with 74 percent in good-to-excellent condition is the best in the last five years for this time of year.

Prices on the other hand, not so much. December corn futures in early July were down 26 cents per bushel from Jan. 1, November soybean futures were down 7 cents per bushel and July wheat futures were down $1.21 per bushel since Oct. 1, 2024.

So how should we approach marketing when prices are continually creeping lower?

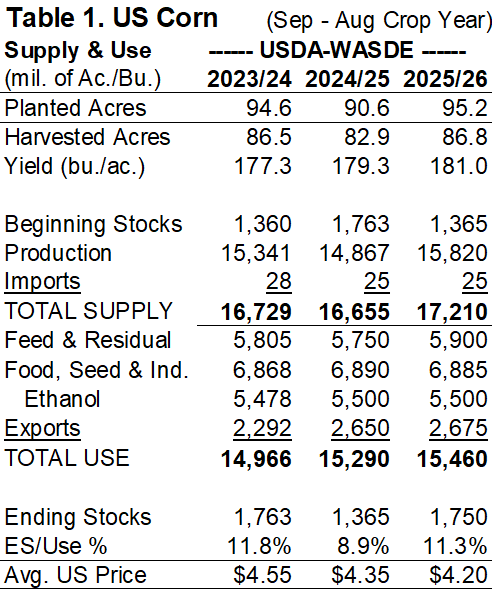

Let’s start with a quick look at current fundamentals for the 2025/26 corn marketing year from the June USDA WASDE report. USDA is currently expecting a 28 percent increase in U.S. corn ending stocks in this 2025/26 marketing year as shown in Table 1, going from 1.365 billion bushels of ending stocks (ES) in the 2024/25 year to 1.75 this year; and while world ending stocks are currently estimated to decrease 3.6 percent, the U.S. share of world ES (and share of world ES less China ES) are forecast at levels not seen since the 2016 to 2018 time period when U.S. corn prices ranged between $3.36 and $3.61 per bushel.

Obviously, there is a lot of time for significant, market moving changes in either the U.S. or world fundamentals to occur between now and August of 2026. Changes that could either move the market significantly higher or significantly lower.

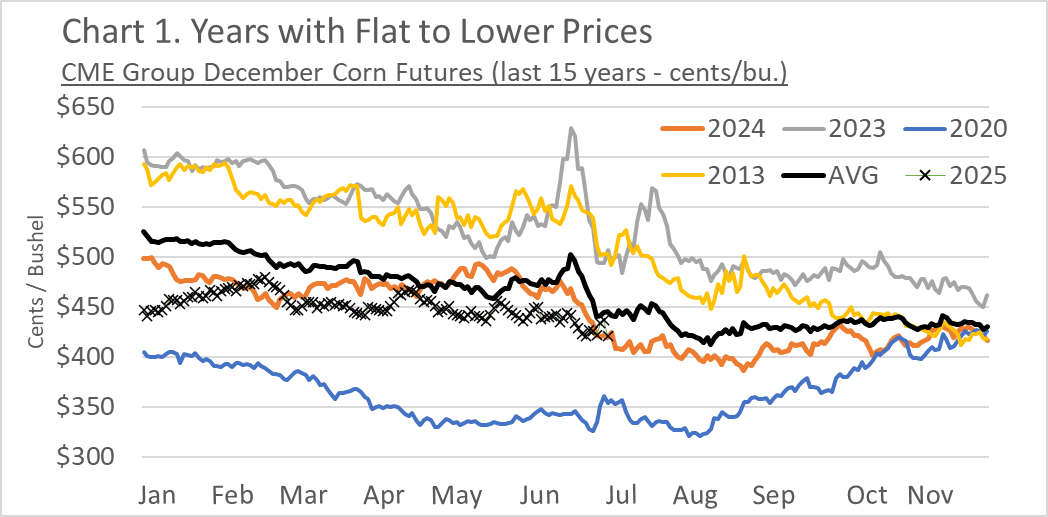

What might we expect between now and harvest? Chart 1 depicts four years in which corn futures were flat to lower all calendar year, along with 2025.

In each of these years, futures trended lower in the first half of the year but after the fear of weather rallies had passed, with the exception of 2020 [1], the downtrend slowed and was arguably more sideways into November.

Is that what will happen in 2025? Obviously, anything can happen but in the short run, between now and harvest, yes, flat to lower prices should likely be expected.

A two-pronged approach including a preharvest plan between now and harvest for those who still would still like to set price on a portion of expected production, or set a price for bushels that will be sold at harvest; plus a second, postharvest plan, designed to take advantage of any market rallies that may potentially come in 2026, is a sound overall strategy.

Preharvest Marketing in a Down-Trending Corn Market

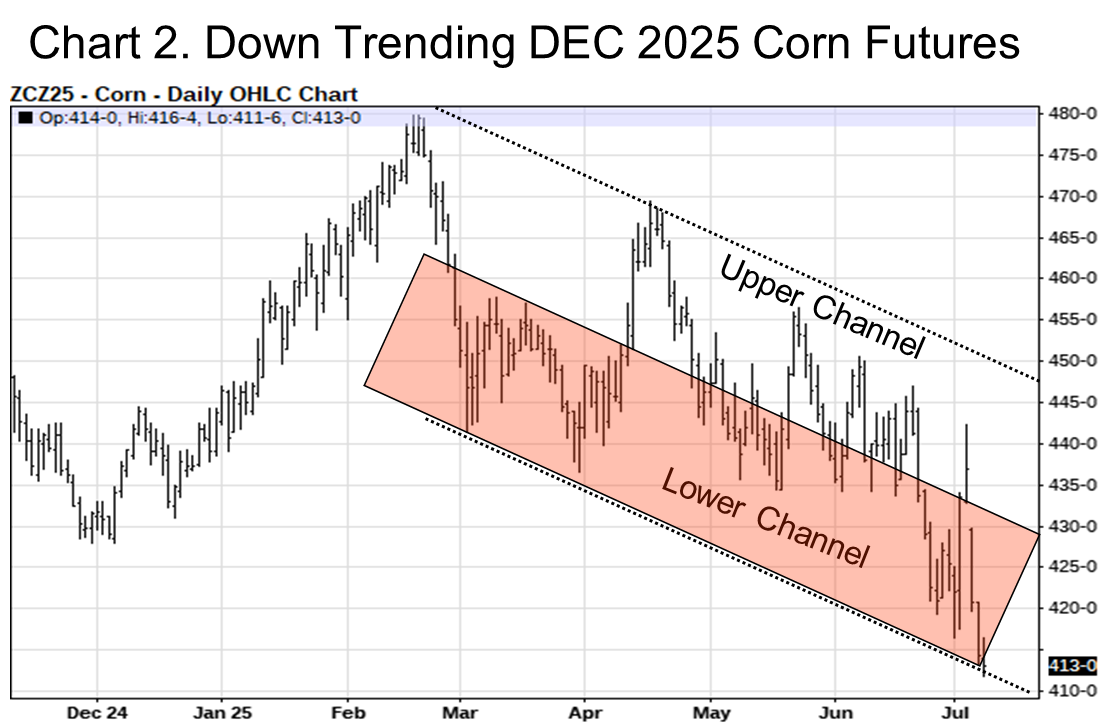

Chart 2 depicts December 2025 CME corn futures and the downward trend seen since mid February (as of the second week of July). The chart further shows both an upper and lower channel, with our simple marketing goal for any preharvest bushels being to make sales in the upper channel. Suggesting an initial price target could be $4.35 December futures, with a secondary target of $4.45. At these futures prices, farmers could take action with either a forward cash contract, futures or options, depending on their knowledge and comfort with each marketing alternative.

[1] The late season rally in 2020 corn futures was largely caused by a confluence of global factors, including supply constraints from a 15% smaller crop in Brazil and disruptions in Ukraine's exports, coupled with increased demand from China, as they worked to rebuild herds after an African Swine Fever outbreak.

It is important to understand your local corn basis and how a specific futures price relates to your local cash price. For example, in one south central Kansas location, new crop corn basis is currently 24 cents per bushel, thus $4.35 December corn futures equates to a $4.11 local new crop corn price. The question that must be answered then is, “how much of my cost of production will be covered by this price?”

Lastly, let’s touch on what marketing alternatives might work best. As mentioned above, forward cash contracts, futures or options, used singularly or in combination, can be used. The key is to use only those that you have a working knowledge and comfort level.

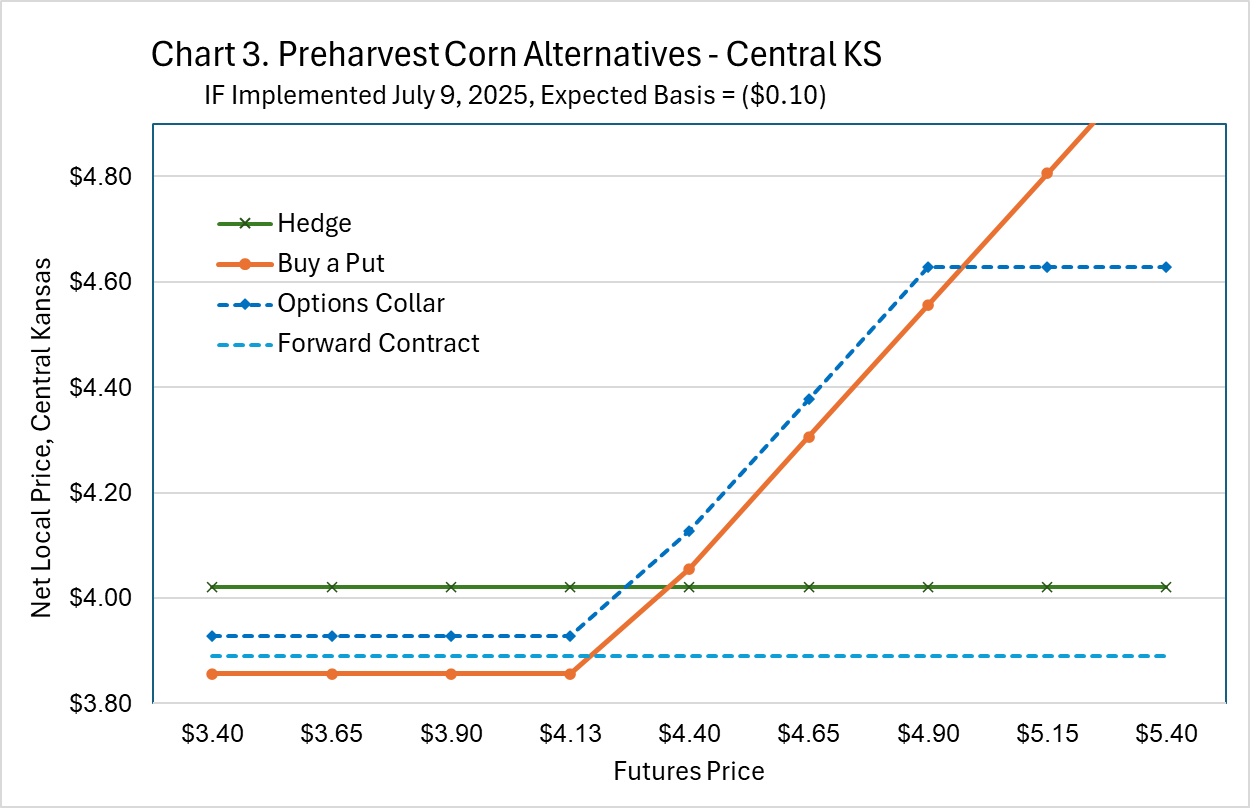

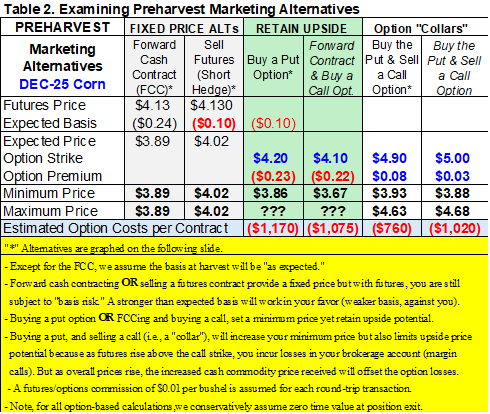

Table 2 helps to examine some of these, separating them into three categories: alternatives that provide a fixed, known price; those that set a minimum but retain upside potential if prices turn higher; and option collars, which provide a greater minimum but in turn, place a cap on upside potential. Chart 3 provides a graphical representation of four of the alternatives outlined.

Fixed Price Alternatives

These include forward cash contracts (require delivery) and short futures hedges. The key here is we need to be satisfied with today’s price. Does it adequately cover costs? Does it fit into your marketing plan?

Minimum Price Alternatives with Upside

These include buying a put option and minimum price contracts (here we assume forward cash contracting, AND buying a call option). Each provides a minimum price less than what the “fixed price” alternatives offer, along with involving the use of commodity options, allowing you to take advantage of any potential price rallies. Again, the forward cash contract will require delivery.

Option Collars

This strategy involves buying a put AND selling an out-of-the-money (OTM) call option (partially offsetting the cost of the put). It will provide a higher floor than the alternatives that retain upside price potential, such as buying a put or a minimum price contract (by the amount of the call); but also establishes a ceiling (at the call strike price). Thus, if prices move above the call strike, you will suffer losses in your brokerage account, but they should largely be offset by increases in the cash crop price. And lastly, do not lock you into delivery.

Preharvest Marketing Discussion

While anything can happen between now and harvest, my expectation is we will likely see flat to lower feedgrain prices. Currently, December corn futures are in a downtrend, and at the time of this writing, in the lower channel of that downtrend. Any time corn futures begin to trade in the upper channel should be viewed as opportunities to make sales, with potential pricing targets of $4.35 and $4.45 December futures.

New crop corn forward cash contract bids (while variable across the state) have been roughly 20 cents per bushel weaker than average basis levels normally seen at harvest would suggest. This is not a reason to avoid them because they still provide a competitive minimum price when compared to option strategies but will not provide any upside price potential if fundamentals suddenly change in the next few months.

The short futures hedge in our example provides the highest minimum price, but like the forward cash contract, no upside price potential; and for many producers, it includes the risk of margin calls if prices do indeed turn up, which is a definite negative.

Buying a put option or forward cash contracting and buying a call are solid alternatives, as they set a price yet allow you the opportunity to take advantage of any significant upturns in the market. Note, buying a put with a higher strike price, for example, a $4.35 put option, increased the minimum to $3.91 in our example, but for a 5,000 bushel option, would cost approximately $1,630.

The option collars are a favorite of mine. They provide a higher minimum and while yes, they do put a cap on your upside potential, I’m less concerned about that as, unfortunately, I am a bit bearish this marketing year. Note: In the example, if you buy a $4.35 put option along with selling the $4.90 call, the minimum price increased to $3.99 and the maximum net cash price was still a respectalbel $4.54, providing my 10 cent harvest time basis estimate is accurate.