Grain Sorghum and Corn Basis Trends in 2025

Author

Published

4/3/2025

So far in 2025, feedgrain basis is running weaker than average, and grain sorghum basis is running much weaker. In the short run, it just means the value of your grain in storage (if you still have some) is less than what it would normally be relative to the futures market, making storage a less profitable endeavor. But in the longer run, if these trends continue, it could negatively impact the effectiveness of futures/options-based marketing tools, lead to less than optimal forward contract bids and maybe even affect the price coverage portion of your crop insurance. Basis is defined as the difference between local cash prices and the associated futures contract. Mathmatically, basis equals local price minus futures price. A great source of basis information is on Kansas State University’s Interactive Crop Basis Tool.

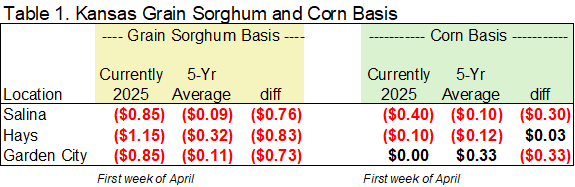

The chart below depicts both grain sorghum and corn basis levels for three locations from central to western Kansas. Corn basis is weaker in Salina and Garden City, and actually slightly stronger in Hays. In all three locations, grain sorghum basis is running much weaker.

For example, in Salina, grain sorghum basis was a negative 85 cents ($3.76 local price minus $4.61 May Corn futures equals 85 cents) on April 3. This was 76 cents weaker (less than) the five-year average basis of 9 cents for that week. Grain sorghum basis in both Hays and Garden City were also much weaker than average, 83 cents and 73 cents per bushel, respectively. Corn basis for the most part is also weaker than average. In Salina and Garden City, corn basis is currently 30 and 33 cents weaker than average, the city of Hays on the other hand was actually 3 cents stronger than the five-year average.

NEW CROP PRICING IMPLICATIONS

Weaker basis, especially weaker than expected basis, will impact the effectiveness of futures- and options-based marketing tools, which will lead to less than optimal forward contract bids and can even impact the price coverage of your crop insurance.

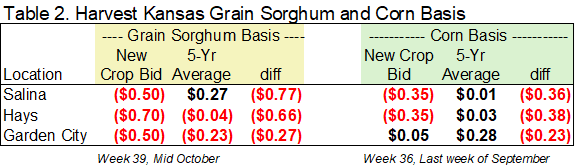

When evaluating a new crop futures hedge, the process begins with the current new crop futures price, for example, let’s use 2025 December Corn Futures of $4.50, we then subtract the per bushel commission cost, approximately a penny, and add our estimate of what basis will be at delivery time. Normally, we’d use something like the three- or five-year average basis for that time. For a Salina corn example we’d use $4.50 futures minus 1 cent plus 1 cent expected basis, arriving at an expected hedge price of $4.50 per bushel. If the basis is as expected, the farmer would net out between futures and the cash market, a $4.50 price per bushel for their corn delivered in Salina. But if basis turns out to be 40 cents weaker, the farmer would only net out between futures and the cash market, a price of $4.10. Table 2 shows the basis associated with new crop forward-contract bids and compares them with the five-year average basis near harvest.

Like the current basis depicted in Table 1, the new crop basis evaluated in Table 2, is also significantly weaker than the five-year averages. Comparing the two feedgrains, while the basis weakness is similar between corn and grain sorghum in Garden City, at the two more central Kansas locations, grain sorghum basis is much weaker relative to corn.

WILL THIS WEAKNESS CONTINUE?

Normally, relative basis strength or weakness is impacted most by crop year fundamentals. For example, a large crop will typically result in a weaker basis for the entire marketing year, and a short crop, in a stronger basis relative to “average.” The fact that new corn crop bids in all three locations are somewhat weaker than average suggests grain buyers are taking a cautious approach to forward pricing, and given the tariff situation currently occurring, no one should be surprised. The reason the new crop grain sorghum bid in Garden City is also only somewhat weaker than normal is likely reflective of the closeness in demand for both these crops as a feedgrain in that part of the state.

The much wider basis for grain sorghum (relative to average) in Hays and Salina is likely reflective of the impact that grain sorghum exports has on the value of grain sorghum in that part of the state.

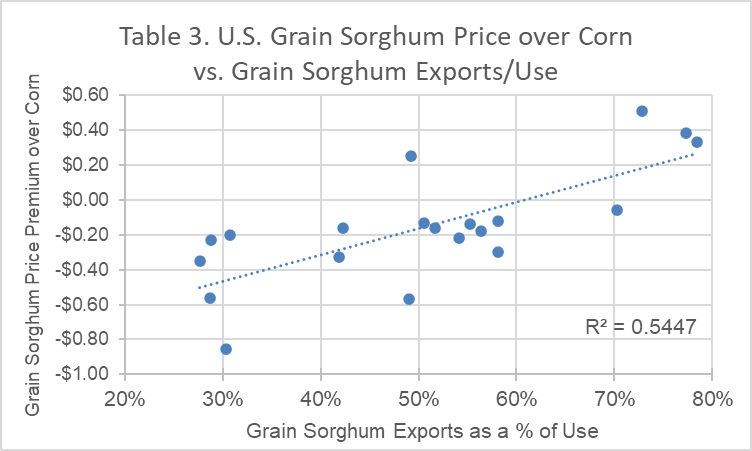

Table 3 charts the annual grain sorghum price premium or discount relative to corn, and the percentage of total grain sorghum usage dedicated to exports on a crop-year basis. For example, when grain sorghum exports are large, more than 70 percent of total use, grain sorghum brings a premium over corn. But when the majority of grain sorghum use is as feed, competing with corn, grain sorghum is sold at a discount to corn. If we see 6.57 million acres of grain sorghum planted (as per the Prospective Plantings report), 87.5 percent is harvested, at a trend yield of 63 bushels per acre, we’ll likely have greater production (362 million bu.) than 2024, but if China does not import significant levels, and exports as a percentage of total use is near 30 percent, it is very likely that grain sorghum basis will continue to run much weaker than the five-year average this fall.

Weaker basis can also impact how well the price-coverage portion of your crop insurance will work. This is because the Harvest Price used for Revenue Protection is based on the average December Futures Contract price for the month of October, and if the cash price you actually receive is much lower than expected because of an extremely weaker basis, the difference between expected/average basis and actual basis at harvest represents a gap in price protection.