Pinpointing Policy: Crop Insurance

Published

10/4/2023

U.S. Department of Agriculture (USDA) Risk Management Agency (RMA) programs and insurance policies are a vital and growing part of the safety net for Kansas farmers and ranchers. RMA data shows that between 87-100 percent of our state’s primary crops, such as wheat, corn, grain sorghum and soybeans are insured each year. American Farm Bureau Federation(AFBF) policy 239 / National Farm Policy, Farm Bill Principles under we support, states, “8.1.4. Risk management tools that include both federal crop insurance and commodity programs as top funding priorities,” and “8.2.7.1.1. A robust crop insurance program, with no reductions in premium cost share. We oppose means testing, income limits, or add ins, such as required production practices, that might limit the availability or adversely impact risk pools.” Further, AFBF policy 225 /Risk Management/Crop Insurance,1.3. We Support, lists 110 items that Farm Bureau supports, and a word search shows the two words together, “crop insurance,” is listed 88 times in the AFBF policy book.

Yes, crop insurance is a vital part of the safety net for Kansas farmers and ranchers and is extensively included in Farm Bureau policy. Members are encouraged to review KFB’s current policy to best ensure its focus is on the key issues impacting their farms.

One crop insurance issue that often comes up is declining or inadequate APHs, or actual production histories1. APH is important because the amount of insurance available to a farmer is based on the farmers average historical yields. For example, the APH yield is multiplied by the farmer’s selected level of coverage and the crop price to determine the amount of insurance available to replace lost income (for example, 60 bushel APH x .75% coverage x $7 = $315 of insurance coverage).

In times of drought, especially multi-year droughts, a field’s or farm’s APH may significantly erode and the premiums farmers must pay increase. APH yields decrease because we’re adding the drought reduced yields into the 10-year average and premiums increase because federal crop insurance is mandated to be actuarially sound, requiring a loss ratio performance of “not greater than 1.0” – meaning over time indemnity payments paid out to farmers should equal the total premiums invested into the system. AFBF policy 225 / Risk Management/Crop Insurance supports this concept, as 1. Crop/Revenue Insurance, 1.3. We Support, states, “1.3.6. Annual reviews to ensure proper premium ratings that are actuarially sound by crop, county and state.” Addressing the issue of declining APHs, AFBF policy #225 under we support also states, “1.3.43. The structuring of crop insurance policies so that premiums do not continue to increase for producers whose APH yields are lowered due to multi-year losses.” To date, for many farms in western Kansas, this still remains a problem. A paper discussing the concept of increasing federal cost-share percentages as a possible solution to this problem can be found here.

Another issue that has been top of mind for many Kansas livestock producers is the lack of risk management tools for livestock, especially cow-calf producers. Farm Bureau policy 239 / National Farm Policy, 8. Farm Bill Principles, 8.2.7. Title XI, 8.2.7.1. We Support, addresses this in section “8.2.7.1.3. Develop and maintain adequate risk management tools for livestock producers including contract growers.” And RMA listened, with the recently released Weaned Calf Risk Protection policy, available in several states (not yet in Kansas) in 2024. Kansas Farm Bureau will be advocating for quick expansion in the years to come.

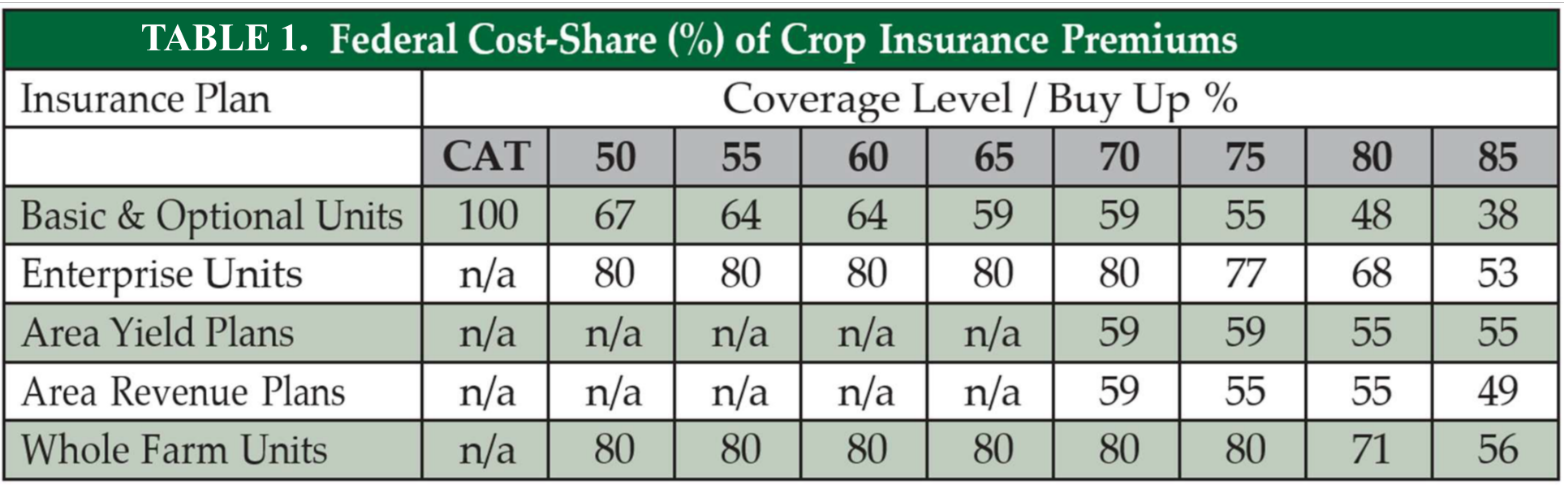

We examined Kansas crop insurance data from RMA for the years of 2022 and 2023, with a goal of examining how Kansas farmers use crop insurance. Three key decisions farmers make when buying crop insurance are a) the crop insurance policy, b) the coverage level, and 3) the unit structure2 in which to insure. These are all interrelated and impacted by the fact that different combinations of crop insurance policy, coverage level and unit structure have differing levels of federal cost-share, or portion of the overall premium paid by the federal government. Sound insurance programs need high levels of participation and the current public/private relationship that exists, with both farmers and the federal government contributing to the overall cost of crop insurance helps manage crop enterprise costs and encourages greater participation in this vital farm safety net program. Background on federal cost-share participation and research showing that in the long run it encourages farmers to buy-up coverage, enhancing the safety net and can be found in this USDA Economic Research Service article. Table 1, depicts the various federal cost-share percentages paired with the appropriate crop insurance unit structures and coverage level selections. This percentage increases up to the 70 percent coverage level, encouraging farmers to “buy up,” and then slowly diminishes at the highest coverage levels. Note that for enterprise units, the federal cost-share begins at the 80 percent level, encouraging its use and reflecting the fact there will likely be fewer indemnities paid.

CROP INSURANCE POLICIES USED IN KANSAS

While there are many different types of crop insurance policies a farmer can purchase (see your local Farm Bureau Financial Services crop agent to learn more), the three primary policies used in Kansas include:

Revenue protection (RP). Revenue protection policies insure producers against both yield losses due to natural causes and revenue losses that would result if prices rise during the growing season. It does this by utilizing two estimated prices based on the associated futures contract, a “projected price” calculated prior to planting, and a “harvest price” calculated at/after harvest, using the greater of the two to determine indemnities. In Kansas this is by far the dominant crop insurance policy, covering 95.1 percent of wheat acres, 96.4 percent or corn, 95.2 percent of grain sorghum and 96.1 percent of soybean acres.

Yield protection (YP). Yield protection, along with actual production history (APH) policies are some of the oldest and most widely available crop insurance products in the U.S. These policies protect farmers against yield losses due to natural causes and use a projected price (either futures-based or some other early-season calculation) to determine indemnities. Yield protection policies represent 4.6 percent of wheat acres, 3.2 percent or corn, 4.8 percent of grain sorghum and 3.8 percent of soybean acres in Kansas.

Revenue protection, harvest price election (RP-HPE) is much like RP but relies only on the futures-based, “projected price” to determine indemnities and represents less than 0.5 percent of wheat, corn, grain sorghum and soybean acres in the state.

COVERAGE LEVELS USED IN KANSAS

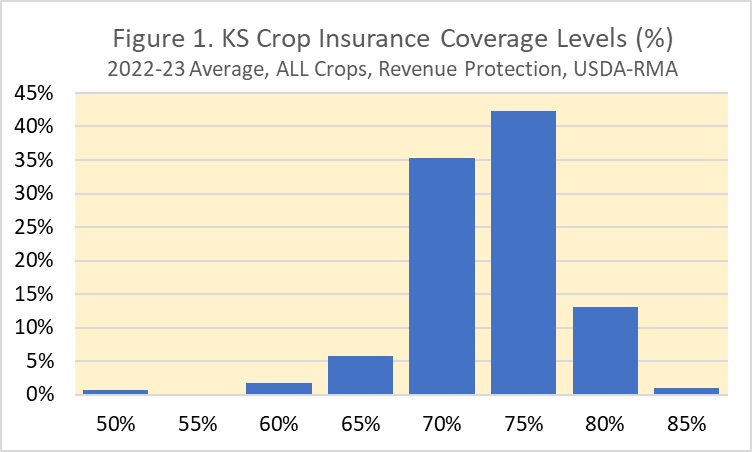

Coverage level is the producer selected percentage of APH yield he or she wishes to insure, ranging from 50-85 percent of APH. In Kansas, the most popular coverage level is 75 percent. With more than 77 percent of RP acreage covered at either 70 percent or 75 percent where federal cost-share is optimized.

CROP INSURANCE UNIT TYPES USED IN KANSAS

As mentioned previously, unit structure refers to the specific acreage that APH, premiums and indemnities will separately be calculated for and include optional (the smallest unit size with the greatest risk and highest premiums), basic units and enterprise units (that include all of the acres planted to a specific crop in a county, with the lowest risk and lowest premiums per acre). In Kansas, optional units are selected in the western third and enterprise units dominate in the eastern third.

Why? It is likely because in eastern Kansas, “units,” or fields within a county are located more closely together and for even singular events like a hail storm, it might hit nearly every field, making enterprise units and their lower premiums work well. In western Kansas, where fields in a county are often farther apart, the singular event may only hit one or two fields and with all production combined for loss calculations, it may not register as a loss, thus more interest in optional units.

Enterprise units also work well if the loss is more regionally based – like drought, where the entire county is often impacted.

Summing up, RMA programs and individual policies are a vital part of the safety net for Kansas farmers and ranchers, and protecting these programs are a high priority of Farm Bureau when advocating for the farm bill. These programs and policies are often dicussed by various KFB Ag Advisory committees, but individual members and county boards are also encouraged to discuss and bring forward any recommendations regarding how to make them work better for your farms and ranches.