Pinpointing Policy: Fertilizer Update April 2024

Published

4/10/2024

Even though the United States is the No. 3 producer of fertilizer in the world, we still must import additional nitrogen (N), phosphorus (P) and Potassium (K) to meet our needs, especially N and K. According to the International Fertilizer Association, in 2018 the world’s largest producers were:

- Nitrogen: China, 24.6 percent, U.S., 11.6 percent and India, 11.3 percent of global supply.

- Phosphate: China, 37.7 percent, U.S., 9.9 percent and India, with 9.8 percent of the global supply.

- Potassium potash: Canada, 31.9 percent, Belarus, 16.5 percent, Russia, 16.1 percent, China, 9.7 percent, with these four countries representing about 80 percent of the world’s potash. The U.S. ranks 11th in potassium production, at 0.8 percent.

Because of our need to import fertilizer, cost, availability, production and trade are key member concerns.

Trade Issue: 2020 countervailing duty investigation and determination that imports of phosphate fertilizers from Morocco and Russia had materially injured the U.S. domestic industry. Mosaic company claimed that unfairly subsidized foreign companies were flooding the U.S. market with fertilizers and selling the products at extremely low prices. In this case, tariffs on phosphate fertilizer imports from Morocco (19.97 percent) and Russia (9.19 percent to 47.05 percent) were applied, which essentially shut these imports down. In November 2023, as part of an annual review, and with ag industry and Farm Bureau input, the U.S. Commerce Department decided to reduce tariffs on the fertilizers from 19.97 percent to 2.12 percent. It is anticipated this reduction should again make Moroccan imports possible. Farm Bureau continues to seek removal of the tariffs.

Trade Issue: 2022 countervailing duty investigation and determination that imports of urea ammonium nitrate solutions (UAN) from Russia and Trinidad and Tobago had materially injured the U.S. domestic industry. This determination was ultimately rejected by the U.S. International Trade Commission (USITC), and no duties have been applied.

American Farm Bureau Federation (AFBF) policy #251 / Global Environmental Agreements and Treaties, states, “1. We strongly oppose any U.S. participation in any agreement that would: 1.2. Increase costs for fuel, fertilizers and agricultural chemicals;” and “4. We recommend Congress investigate the phosphate fertilizer supply chain outages and high prices created by tariffs placed on imports by the International Trade Commission.” AFBF policy # 252 / International Trade, states under we oppose, “6.5. Tariffs on fertilizer imports, including the antidumping duties placed on solid urea imports.” And in section 13. Sanitary, Phytosanitary and Food Safety Standards/Imports, under we support, “13.1.4. Biannual review of countervailing duties on imported fertilizer products.”

Domestic Issue: Efforts addressing consolidation and competition. In July 2021, Pres. Biden signed an Executive Order on Promoting Competition in the American Economy, which established the White House Competition Council and instructed federal agencies to identify ways to promote competition in all aspects of the U.S. economy. To date, much of the council’s activity has centered on livestock markets but a request for public comment was made regarding Access to Fertilizer: Competition and Supply Chain Concerns, in March of 2022. AFBF comments are here.

Domestic Issue: The Fertilizer Production Expansion Program. In March of 2022, USDA announced efforts to support additional fertilizer production in the U.S. and by September, $500 million was made available to provide grants to help eligible applicants increase or otherwise expand the manufacturing and processing of fertilizer and nutrient alternatives and their availability in the United States. In June of 2023, an additional $400 million from Commodity Credit Corporation (CCC) funds were added to the funding pool, bringing the total to $900 million. The first application window closed Nov. 14, 2022, and the second application window closed Dec. 29, 2022. To date, more than $170 million in grants have been made available, but there have been none specifically approved in or from Kansas.

AFBF policy #339 / Fertilizer, states under we support, “1.1.1. The increased domestic production of agricultural chemicals and fertilizers and streamlining regulatory approval.” This policy, along with Kansas Farm Bureau (KFB) policy Agricultural Chemicals and Fertilizer – AG-3, have many additional recommendations regarding increased domestic fertilizer production, safety, use and regulation.

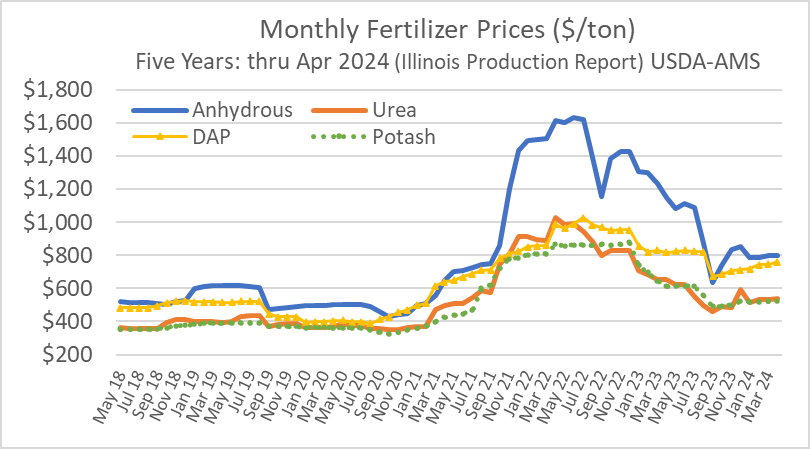

1 As per a recommendation from delegates at the 2021 Kansas Farm Bureau (KFB) Annual Meeting, the KFB Board directed the Advocacy Division to investigate high prices/concentration in the fertilizer industry. At the time, multiple issues including increased world demand as the world emerged from the COVID-19 recession, global supply chain disruptions associated with the uneven recovery, fertilizer export restrictions by China, and the outbreak of war between Russia and Ukraine—both key food and fertilizer producers—generated price shocks (AFBF Market Intel). Since then, while many problems linger and input cost inflation remains sticky, fertilizer prices have receded from the peak reached in April 2022, yet remain slightly elevated versus historical averages. Multiple staff members continue to work this issue, and this paper will continue to be updated periodically.