Postharvest Pricing Decisions

Author

Published

9/6/2024

Overall, conditions and yield prospects remain good for Kansas fall crops this year. Prices on the other hand, not so much. In fact, from the highs reached in May to the lows reached in August, futures prices, DEC Corn down $1.12/bu. and NOV Soybeans down $2.76/bu., have been in a freefall.

So how should farmers approach any postharvest marketing decisions? Well, like a good doctor, our goal should be to do no harm. Implying that our postharvest marketing goal should be to better our position versus harvest values, and if we can’t do that, we should simply sell at harvest and turn our attention to 2025 crop marketing decisions. To help answer that question, let’s examine a few things.

Overall Market Fundamentals

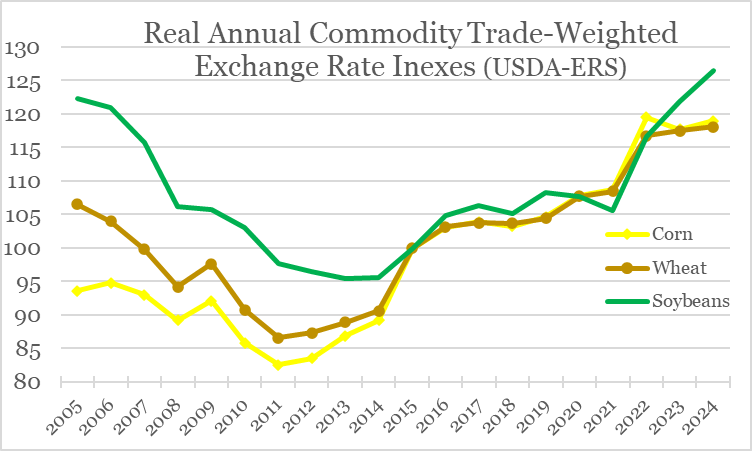

According to the August USDA-WASDE report, since the 2022/23 crop, total grains (wheat, coarse grains and rice) production in the world is estimated to be up 2.7 percent (world oilseeds up 8.2 percent). Year-over-year, 2024/25 world wheat, coarse grains, rice and oilseeds production are all expected to increase again, although at smaller rates. World total grains ending stocks, on the other hand, are estimated to be down 1.9 percent versus the 2022/23 crop and down again this year. World oilseeds ending stocks are UP 26.4 percent since 2022/23 and are forecast UP 16.6 percent versus a year ago.

U.S. total grains production since 2022/23 is forecast up 12.5 percent, but down slightly in 2024/25 versus a year ago. U.S. oilseeds production since 2022/23 is forecast up 7.4 percent, and up 10.4 percent year-over-year. U.S. total grain ending stocks are forecast up a massive 48 percent since the 2022/23 crop and up 12.4 percent from last year, while U.S. oilseeds ending stocks are up 89.2 percent since 2022/23 and 53.4 percent over a year ago.

Yes. A black swan event could happen in the Middle East, Ukraine/Russia, or somewhere else, weather could take a sudden turn in the U.S. (this fall is expected to be dryer) or South America, but the overall fundamentals are increasing production, increasing stock piles and a strong U.S. dollar. All of which is currently making the U.S. the world’s “supplier of last resort,” pressuring market prices, and with nothing currently suggesting a change over the next 12 months.

On Average Does it Pay to Store Postharvest?

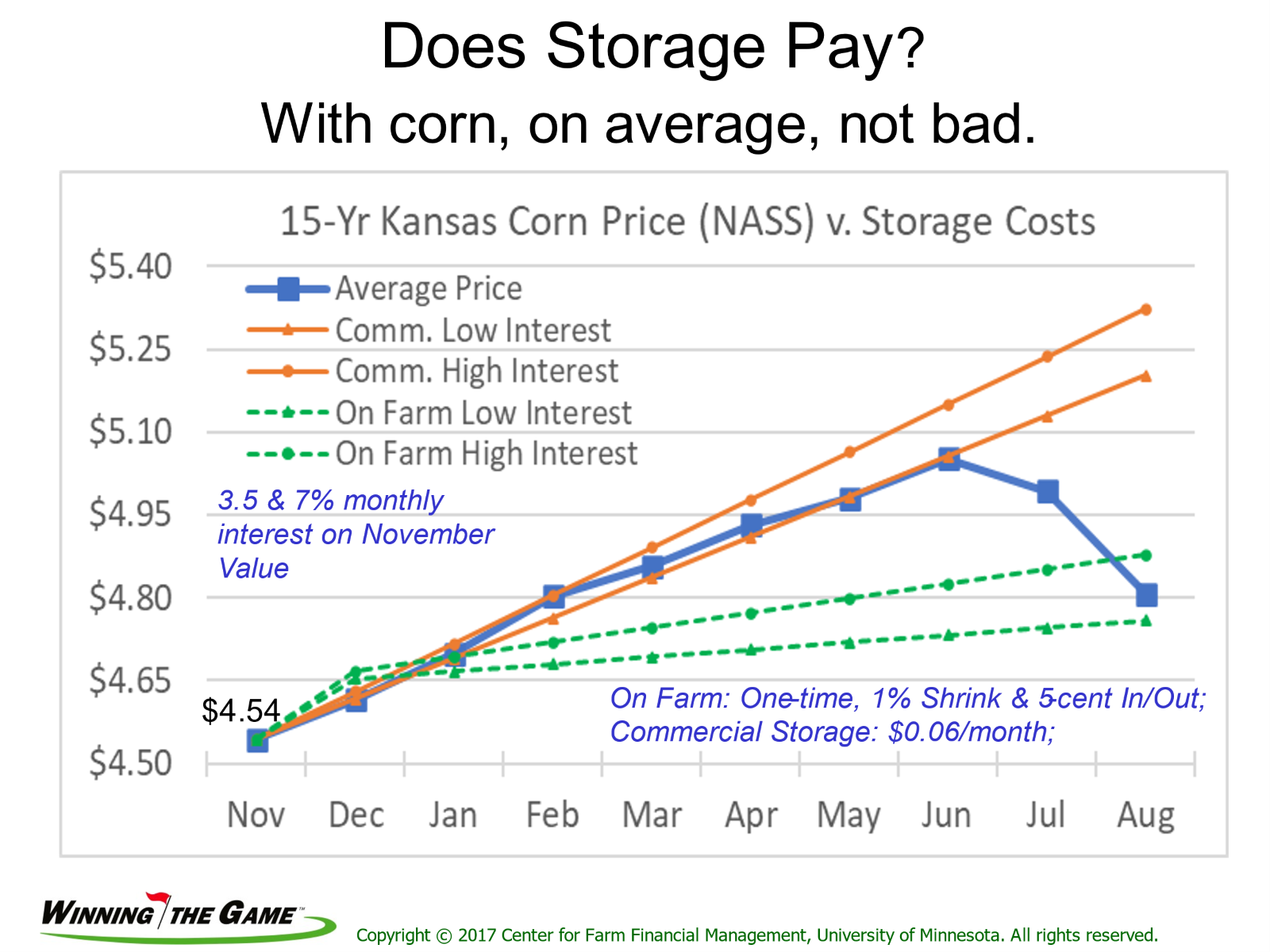

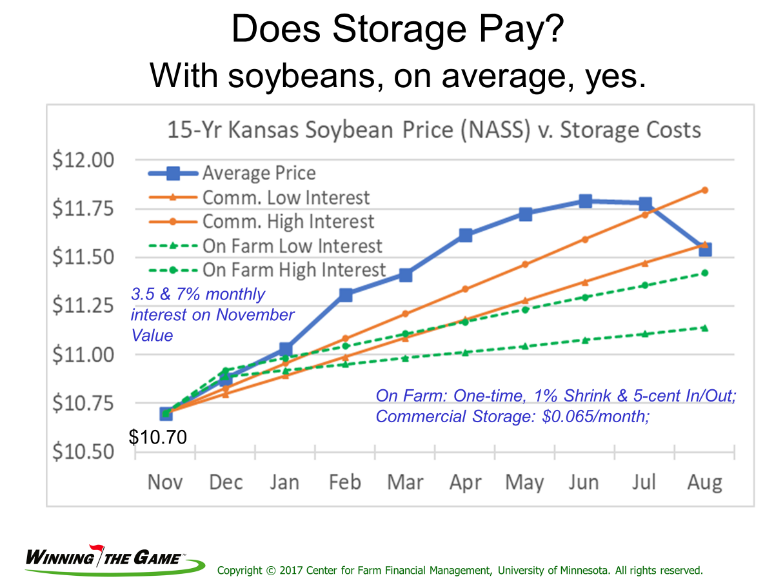

For anyone who tunes into KSUs Winning the Game Webinars or reads my occaisional marketing posts, you know I like to look at the most recent 15-year seasonal averages. So let’s take a look.

The two charts above offer a simple, but consistent examination of the returns to storage for both corn and soybeans in Kansas. We use the monthly average prices received by Kansas farmers (USDA-NASS) and apply estimates for both commercial and on-farm storage, and two interest rate scenaios, with storage costs accruing from December on, and no other risk management tools being used, such as forward contracts, futures or options.

On average over the last 15 years, postharvest storage of corn and soybeans has worked. But will it work this year? Price appreciation after harvest comes from either an overall increase in the futures market that pulls ALL prices higher (i.e., both futures and local cash), and/or a strengthening in basis (i.e., cash prices rising more relative to futures).

As mentioned above, a significant postharvest price rally will require some changes to current market fundamentals. But if we hedge by selling corn or soybean futures, gains through basis appreciation can be obtained.

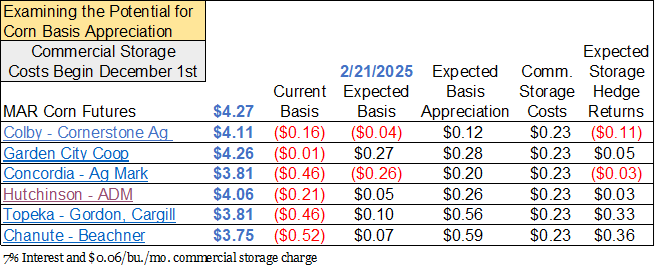

Will we see basis appreciation this postharvest?1 Let’s start with the “carry” in the futures market. Carry being defined as the monthly increase in futures contract prices, extending into the storage season. For example, as of early September, DEC 2024 corn futures contracts were trading at $4.08½ per bushel, $0.18¾ under MAR 2025 corn futures ($4.27¼). Dividing that by three months between those contracts, provides a “carry” of $0.06¼ per bushel, per month, which would not quite cover commercial storage and interest costs. Between the MAY 2025 corn contract ($4.37¾) and MAR corn futures provides a $0.05¼/bu./month carry, and on into the JUL 2025 corn contract ($4.44), the carry weakens further, to $0.03/bu./mo. Futures prices aren’t supportive of hanging on to your corn after harvest.

Basis is the difference between cash grain prices and futures prices. For this example, we’ll use the $4.27 MAR corn futures price and an expected basis for the third week of February that we can obtain from the Interactive Crop Basis Tool on the KSU AgManager website. The next step is to compare current basis levels to what our “expected” basis will be at the end of your storage period (we’ll use the third week of February). Note: given that very little corn in Kansas is harvested, this is a preliminary analysis. Currently, in Garden City, cash corn is at $4.26 per bushel, relative to the 2025 MAR corn futures contract ($4.27), and thus basis is a minus $0.01 per bushel, but in late February, the five year average basis is a positive $0.27, suggesting an expected basis appreciation of $0.28. Subtracting estimated commercial storage costs of $0.23 per bushel (Dec. 1 to Feb. 21) results in an expected storage return of only $0.05 per bushel, and this would only be available IF we hedge by selling MAR corn futures.

The table above examines the potential returns to corn storage for six locations across the state, with the best opportunities located in the eastern third. Note though, because very little corn is harvested at this time, and prices will change, this is a preliminary analysis. Farmers need to conduct their own analysis, using their own costs and prices, closer to actual harvest to make the best decision for their operation.

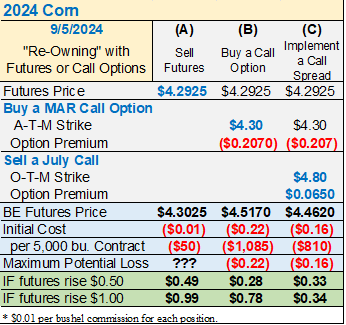

Lastly, if you can’t store, or storage doesn’t appear profitable, but you DO believe there will be a postharvest rally into the new year, then you can sell futures, buy a call option or implement a call option spread (which involves buying an at-the-money call option and selling an out-of-the-money call option to reduce the overall cost, but limiting your upside).2

Footnotes:

1 For the rest of this article, we’ll focus on postharvest corn marketing potential.

2 Space limits the amount we can go into detail regarding these postharvest marketing alternatives. If you don’t feel comfortable with the terminology or their mechanics, you should not consider them, but instead attend/request a Winning the Game workshop to be conducted in your area.